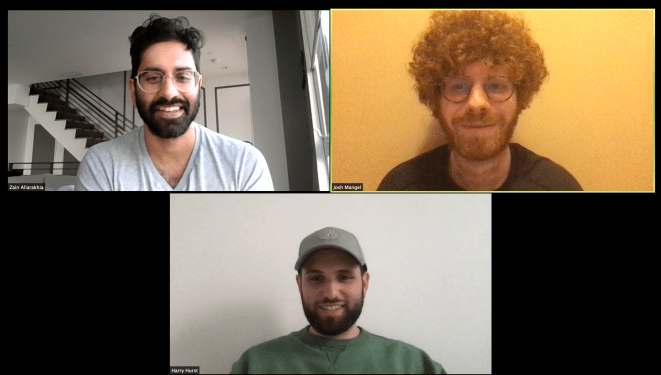

The article discusses the fintech company Pipe, which has raised over $300 million from investors and is well-positioned for growth despite a challenging market environment. The company’s latest move is to replace its CEO, Harry Hurst, with a new CEO who will oversee a significant expansion of the business.

Here are some key points from the article:

- Pipe has raised over $300 million in funding from investors such as Greenspring Associates, Craft Ventures, and Morgan Stanley’s Counterpoint Global.

- The company is well-positioned for growth despite a challenging market environment, with half a decade of runway to make long-term strategic decisions.

- Pipe offers revenue-based financing to software companies, allowing them to convert future revenue into upfront capital without diluting ownership.

- The company has a competitive landscape, with several other fintech startups offering similar services such as Arcc and Capchase.

- Pipe’s new CEO will oversee a significant expansion of the business, including entering new markets and increasing its customer base.

Some possible implications of this news include:

- Increased competition in the revenue-based financing market, which could lead to lower prices for software companies and increased options for founders.

- A potentially more aggressive expansion strategy by Pipe, which could lead to increased growth but also increased risk.

- A continued focus on innovation in the fintech space, with companies like Pipe pushing the boundaries of what is possible in revenue-based financing.