A Sad but Not Unusual Ending for a Company That Tackled Banking Deserts

Sheena Allen, the founder of CapWay, a fintech that aimed to bring financial services to those living in "banking deserts," has announced that her company is shutting down. This decision comes after a tough year for the startup, which faced numerous challenges in the highly regulated and competitive fintech industry.

The Mission Behind CapWay

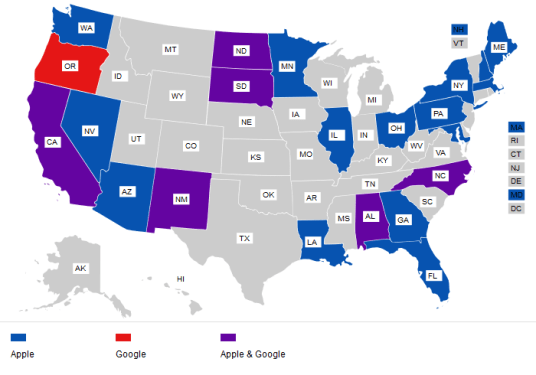

CapWay was founded by Sheena Allen in 2016 with the goal of addressing the issue of financial exclusion in underserved communities. These communities often lack access to basic banking services, forcing residents to rely on high-interest payday loans or high-fee cash-checking services. By offering online banking solutions and teaching financial literacy, CapWay aimed to provide a more accessible and affordable way for people in these areas to manage their finances.

The Journey to Shutdown

According to Allen, the company started winding down last year due to difficulties in securing funding. Despite raising just under $800,000 from investors like Backstage Capital, Fearless Fund, and Khosla Ventures, CapWay struggled to meet the financial requirements set by potential partners. The hacking of Evolve Bank & Trust and the collapse of Synapse also dealt a significant blow to the company’s reputation in the industry.

A Tough Year for Fintech Startups

The fintech industry as a whole faced numerous challenges last year, including regulatory hurdles and reputational damage from high-profile hacks and failures. This made it increasingly difficult for startups like CapWay to secure funding and partnerships. As Allen pointed out, "It takes money to play in a highly regulated industry because you can’t control the changes. You just have to have enough money and time to survive the adjustments."

The Impact on Black Founders

Allen also highlighted the significant challenges faced by Black founders in securing funding. Crunchbase found that Black founders raised only 0.3% of the $79 billion invested in U.S.-based startups in the first half of last year. This lack of investment not only affects individual companies but also perpetuates systemic inequalities.

Lessons Learned and Future Plans

Despite the setback, Sheena Allen remains committed to addressing financial inclusion. In a LinkedIn post announcing CapWay’s shutdown, she expressed her pride in the work accomplished and emphasized that there is still much to be done. Allen is currently exploring potential entrepreneur-in-resident opportunities at venture firms and is pondering her next startup idea.

The Importance of Resilience and Community

As entrepreneurs navigate the challenges of building a company, it’s essential to remember the importance of resilience and community. By supporting one another and learning from setbacks, we can build stronger, more inclusive ecosystems that foster growth and innovation.

Related News

- TikTok Users’ Attempted Migration to Chinese App RedNote Isn’t Going Too Well: Despite the growing popularity of TikTok, some users have attempted to migrate to alternative platforms like RedNote. However, this transition has not been without its challenges.

- A Comprehensive List of 2024 and 2025 Tech Layoffs: As the tech industry continues to evolve, it’s essential for companies to prioritize flexibility and adaptability in order to remain competitive.

By staying informed about the latest developments in fintech and entrepreneurship, we can better understand the challenges faced by startups like CapWay and work towards creating a more inclusive and supportive ecosystem for all.